An unusual process: the French nuclear regulator is asking the population about their gut feeling on a topic where technical expertise is required at the highest level: the commissioning of the highly controversial reactor pressure vessel in Flamanville (Normandy), also among experts.Among the many respondents, a whistleblower, the former president and chairman of one of the steel and metal processing companies at the Burgundy heavy industry site Le Creusot, speaks out.His insider insights from the times when today's Areva companies are running under the aegis of the financial speculator Michel-Yves Bollorée are a terrifying description of the catastrophic conditions, the results of which are being made public in the current Areva scandal. It is about inferior production committee in key components for nuclear high-risk technology, sloppies, fraudulent document falsifications, cover-ups and the greed-driven plunder of the French national economy. Here is the translated text :

EPR: is the risk of a state affair reason enough to address the risk of the company taking over?

Should the responsibilities which led to the manufacturing faults of the Flamanville reactor be longer concealed, and should the operation of a defective nuclear component be released, from which no one can assess the consequences - in the case of a crack in the reactor? (Copy of my reply to the public hearing launched by the Atomic Authority)

The Flamanville EPR is already a state scandal, no matter whether it starts the operation or not.The fact that this scandal puts the credibility of the country's industry at risk is a sufficient reason to address the risk of a faulty component being used, which is a risk to the population, albeit small. This is the real meaning of the offered citizen consultation, because otherwise it might seem absurd. The population of the country, whose opinion is asked, does not, in its overwhelming majority, have the technical qualification to assess the validity or dangers of the Reactor Pressure vessel (RDB) of the European Pressurized Water Reactor (EPR). For neither in Flamanville, nor in Fukushima, or Chernobyl was any expert, according to the state of science, capable of assessing the extent of the damage before the incident occurred.

Due to the responsibilities involved in the production of the components of the RDB and the underlying corruptions, based on my own questions and personal experience in Creusot 's workshops, I will make my contribution to the consultation, Nuclear safety ASN was launched.

Jean-François VICTOR, President and CEO of UIGM ( Unité Industrielle de Grand Mécanique ), who became CREUSOT MECANIQUE on July 31, 2003

I make clear that I am unbiased on the principle of nuclear energy.

At what date were the bottoms (bottoms and lids) of the RDB of Flamanville 3 produced and by whom?

The note of the ASN meeting of 23 March 2016 with the HCTISN ( Committee on Transparency and Information on the Nuclear Safety Report of the Monitoring Group on the RDB Flamanville 3 ) shows the production history on the basis of the data provided by the AREVA Group, To which ASN never came back. The foundry data, probably provided by AREVA, are the 23.1.2007 for the RDB soil and 5.9.2006 for the RDB cover. But a note dated September 26, 2016 from the Nuclear Safety Engineering Bureau John Large & Associates (commissioned by Greenpeace) reveals a longer period of further dates from 2004 to 2007, p. 20.

"Creusot began manufacturing the upper and lower pressure vessel components around the year 2004, with the manufacturing process extending to 2007. During this period, ASN expressed its opinion on the state of the technical documentation of the quality test QT for the reactor pressure vessel RDB, [33] to warn Areva of the risk of producing these components without an approved quality test. [34]

This indicates that the Creusot process chain for production was not assessed and approved by the ASN at the time of production of the RDB dome for Flamanville 3, and that there was therefore no certificate of conformity for the two calves. [35] "

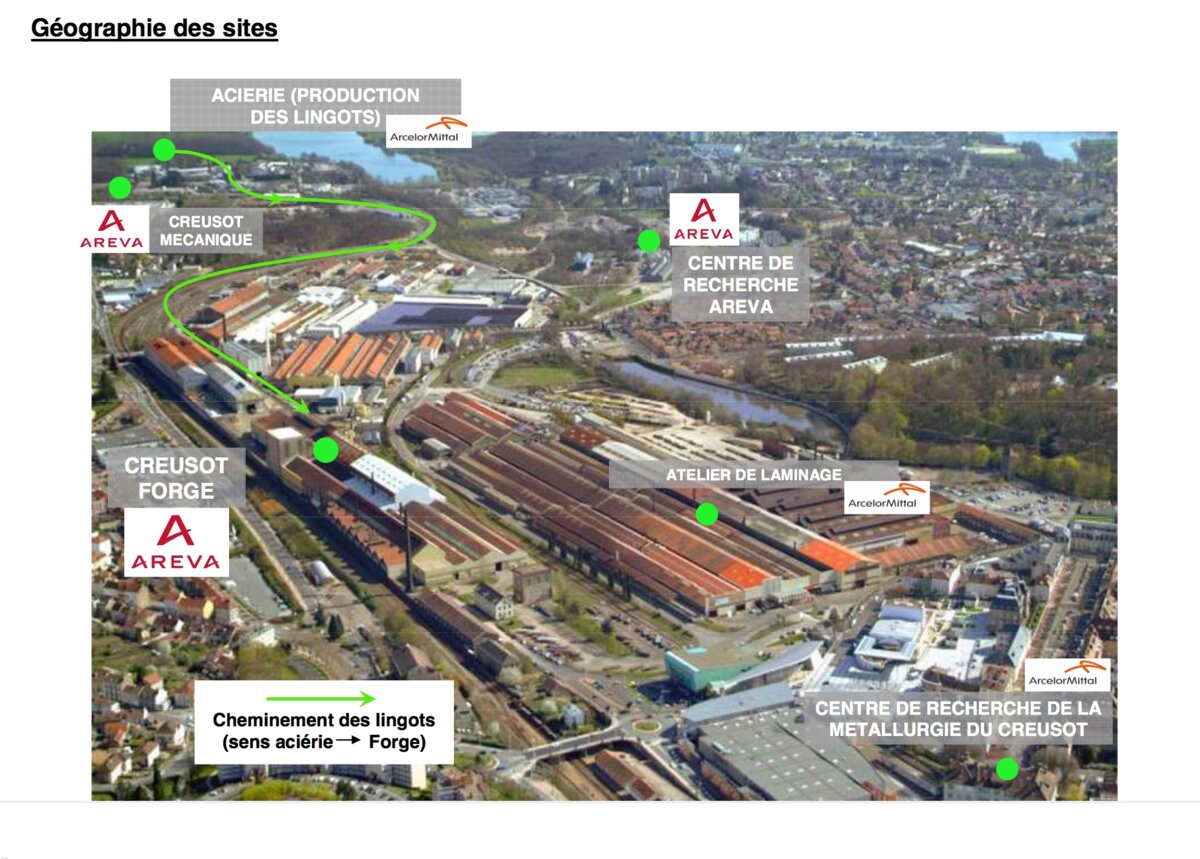

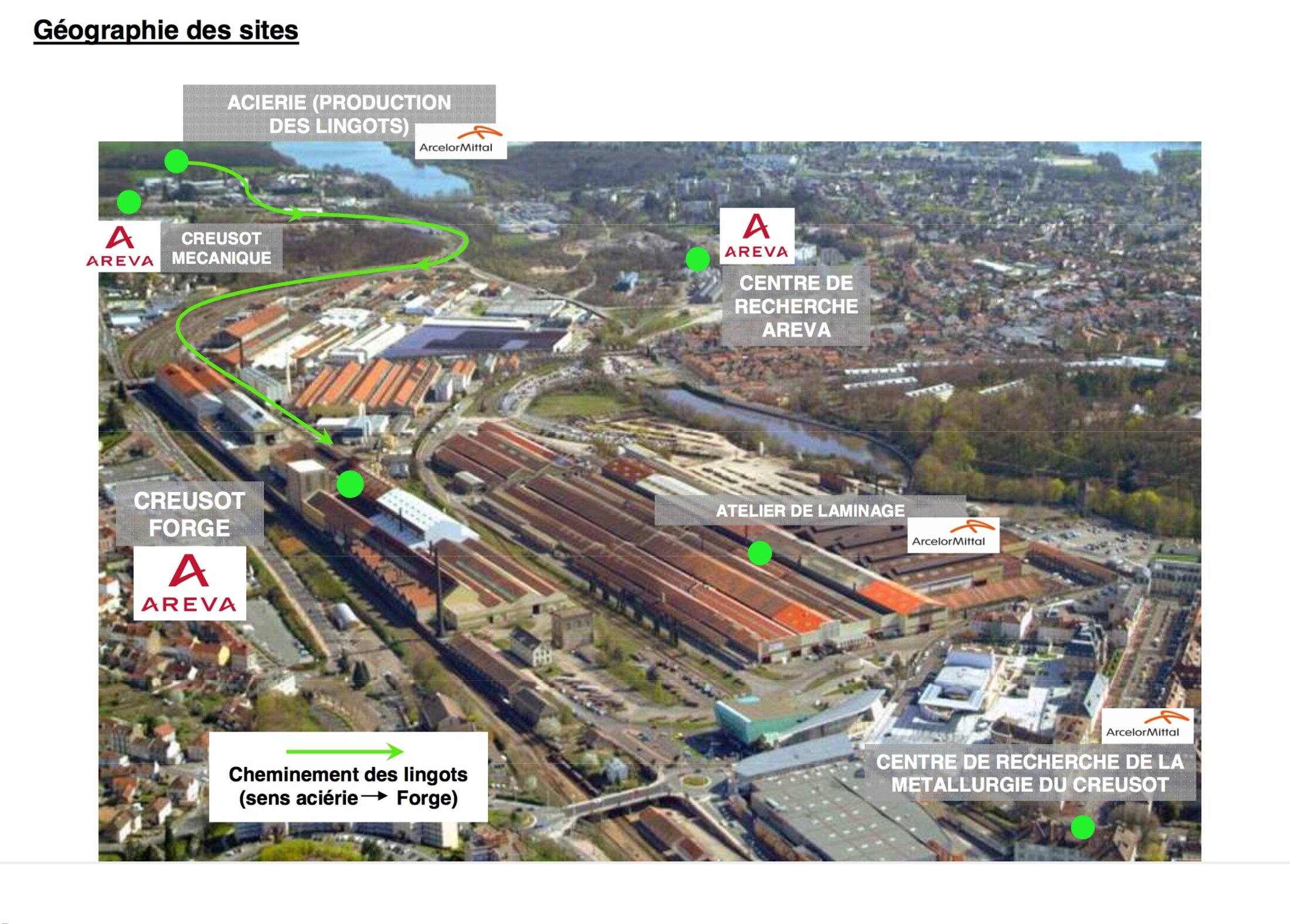

The dates proposed by John Large are much more likely because the decision to start production isnot made on the morning of the start of the casting, the production takes place at three industrial sites, Industeel (Arcelor), Creusot Forge (for the actual forging processes) and Creusot Mécanique (adaptation of the part).

Agrandissement : Illustration 1

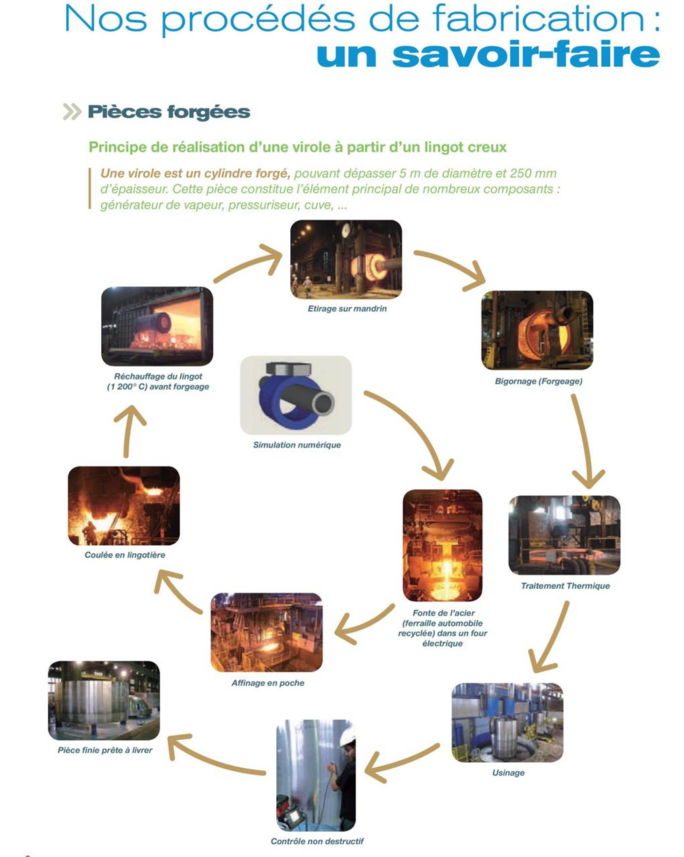

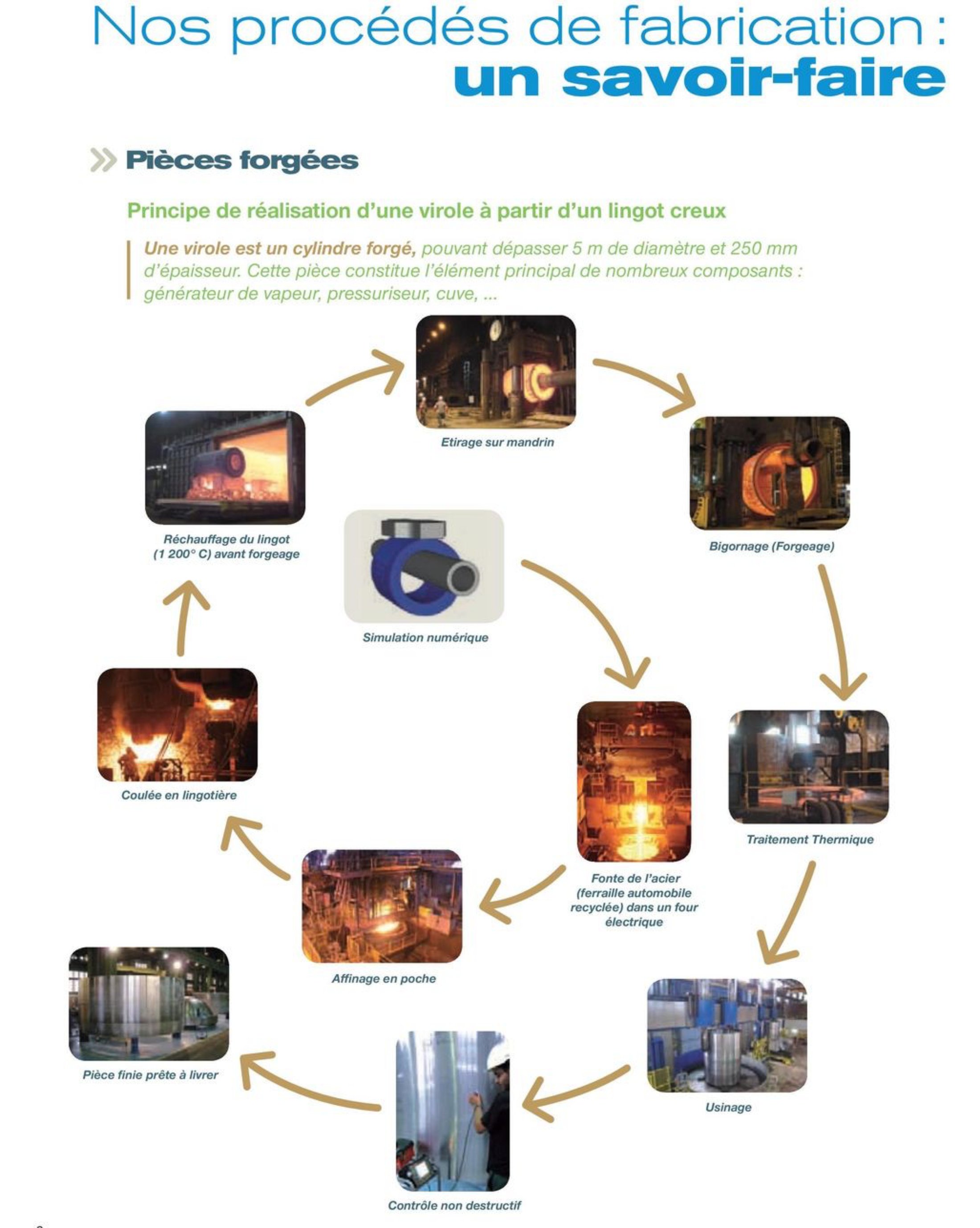

This involves numerous preparations in the run-up, the mobilization and coordination of more than twenty skilled workers (technician, blast furnace boss, project manager, controller, quality coordinator, blacksmith, milling cutter, research and development engineer, waltz, machinist). .), The organization of the project procedures and the planning can take several months before the recycled automobile scrap melts and the first casting process (by Industeel).

Agrandissement : Illustration 2

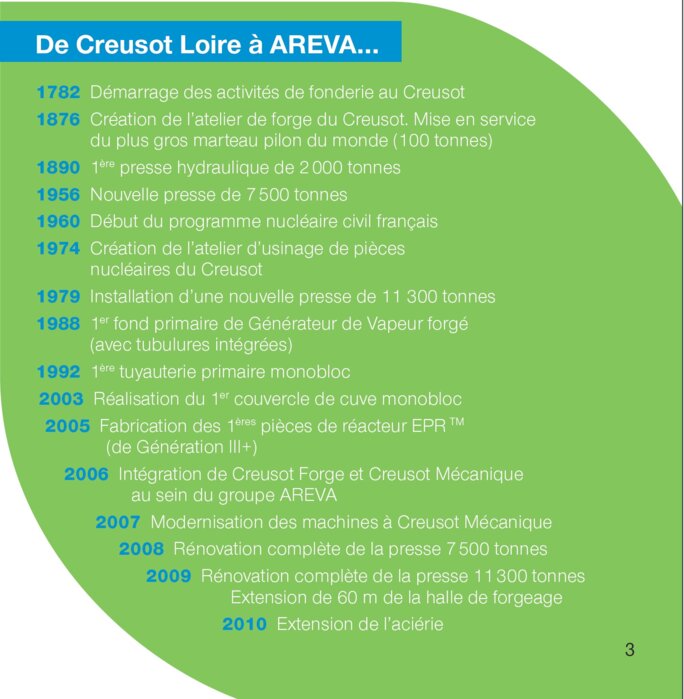

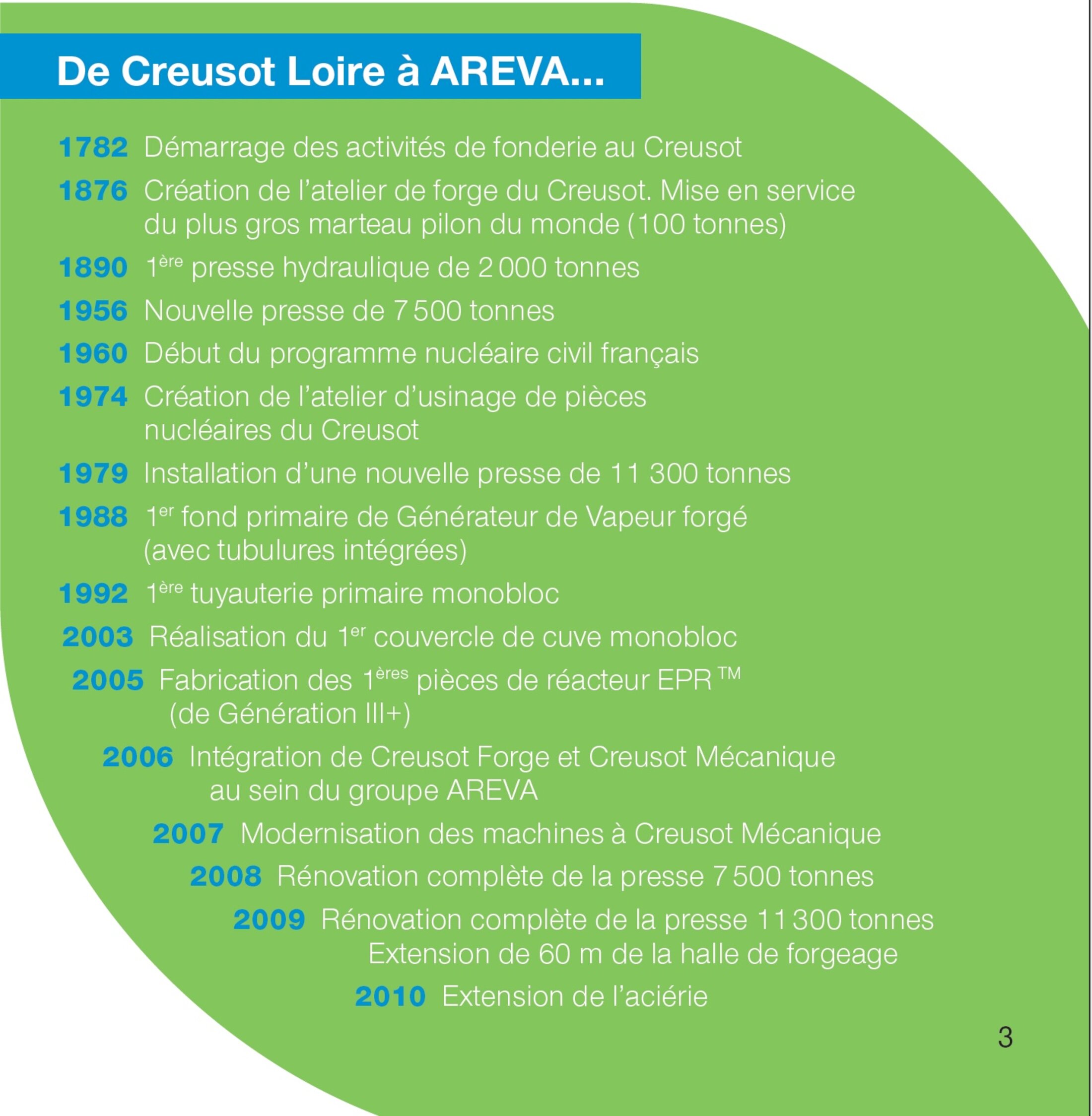

By the way, the Creusot Forge and Creusot Mécanique brochure, printed in January 2011 , provides a history of these industrial properties on page 3, which in 2005 mentions the production of the first parts for the EPR Reactor Generation III +.

Agrandissement : Illustration 3

Now, Creusot Forge and Creusot Mécanique were wholly-owned subsidiaries of the SFARSTEEL Group from July 2003 to October 2006, which themselves were a 100% subsidiary of the FRANCE-ESSOR group, which is owned by Michel Yves Bolloré (about 97% Brother Vincent). On the same page, Dieselbe og Brochure makes it clear that the two companies were integrated in 2006, more precisely in October 2006.

However, the production period of the EPR parts is overlapping with the date of the sale of the companies, the specificity of which must necessarily be underlined here.

Michel Yves Bolloré got Creusot Mécanique (at the time under the name UIGM) due to insolvency / trade-in, comparable to a takeover after Areva (30% shareholder) refused to participate in a capital increase of € 1 million. The agreement between Areva and Michel Yves Bolloré from 2003 is therefore clear: a first gift.

As far as the smithy was concerned, Areva was the main clientele, the pressure for Arcelor to accept the idea of separating, should not have been particularly high, and was probably accepted with a sufficient company bonus: Second gift.

Yves Michel Bolloré, who, on the initiative of Areva, obtained an appraisal of the Commercial Court of Chalon sur Saone from July 31, 2003 , Creusot Mécanique for 800,000 € , sent two factories (Creusot Mécanique and Creusot Forge) in October 2006 (three years later) Same Areva for € 170 million . An amount that means a goodwill of nearly € 100 million: third gift, always at the expense of taxpayers.

The owners and managers of SFARSTEEL / France-ESSOR are responsible for the start of this production, which was probably already very advanced when selling SFARSTEEL to Areva. And Michel Yves Bolloré had a good reason to ignore the warnings of the Atomic Authority (ASN) to the Areva group, and to begin the production of the parts (which are decisive for the projects and the future of the French nuclear industry), since he is negotiating with Areva The sale of its facilities in Le Creusot. He therefore offered Areva the opportunity to justify the obvious and almost ridiculous overvaluation of the factories, which were SFARSTEEL, to their shareholders (ie mainly the state).

Agrandissement : Illustration 4

And the leaders of the "nuclear giants" probably had other reasons to close their eyes, because all the evidence of an underlying corruption (to the detriment of the taxpayer) was united here.

The surrender of Creusot Mécanique (UIGM) to Yves Michel Bolloré, as well as the goodwill amount when purchasing SFARSTEEL, are highly suspicious. And the Economics Minister recently spoke in a very angry statement of "agreements without state control". On this occasion, Bruno LeMaire made it clear that the cost of the rescue of Areva is "higher than the savings that the Minister of Finance will have to make in 2017 to get us back to the 3% limit (budget deficit as measured by GDP)" ,

The only explanation for the decision in Le Creusot to make the lid and bottom of the RDB while the workshops were at their capacity limits is explained by the exorbitant overvaluation in favor of Bolloré . This is the obvious reason why these components have been internally validated, despite the exhortations and warnings from ASN.

In order to assess this overvaluation better, it is appropriate to keep track of the balance sheets and reference documents, the years after the valuation and the future of these companies. The balance sheet 2011 of Areva NP SAS reports on a downside correction of SFARSTEEL in the amount of € 80 million on page 13 and on page 27 on losses of € 9,124 in the accompanying management report of the Chairman of the Management Board, Knoche. For 1 €, CREUSOT FORGE and CREUSOT MECHANIQUE generate a loss of 1 €. Management report

The financial director of Areva has had to remove the traces of an acquisition since 2012, whose profitability immediately proved to be very controversial and catastrophic. On page 14/43 of Areva NP SAS's balance sheet 2012 , one can read:

"During the 2012 financial year, three mergers were undertaken aiming to combine Areva NP SAS, Areva CREUSOT FORGE SAS and CREUSOT MECANIQUE SAS in the same legal entity in order to make the most efficient use of capacity in terms of industrial efficiency, flexibility and sustainability. These mergers were also intended to provide greater clarity to the activities of the forging and forming product line.

... a first merger of CREUSOT FORGE SAS by Areva CREUSOT FORGE SAS was concluded with effect from 1 July 2012 with a retroactive tax and accounting as of 1 January 2012.

A second merger between CREUSOT MECANIQUE SAS and Areva CREUSOT FORGE SAS was carried out with effect from 31 December 2012 midnight and retroactive taxation and accounting as of January 1,

The third merger consisted of the inclusion of Areva NP SAS by Areva CREUSOT FORGE SAS, which was implemented with effect from 31 December at midnight and retroactive tax and accounting on 1 December 2012. "

The losses of Creusot are therefore forgotten and lost in the losses of Areva NP SAS, systematically "wiped" by ... the taxpayer.

This regrettable production will amount to around 132 million euros for Michel Yves Bolloré, who did not hesitate to congratulate in the press, and in an interview in the Journal de Saône et Loire (June 16, 2006) of a purely patriotic decision In the industrial tradition of Gaullism.

Agrandissement : Illustration 6

From one way to the next

From 2008, Areva will have the need to acquire 1.3% of the capital of JAPAN STEELWORKS, which could contradict the recent takeover of SFARSTEEL as JSW is the only and direct competitor at this time.

The manifestly paradoxical reversal of the Group's position in the course of the reference documents of the Group can be seen:

Areva Reference Documents 2007 , page 206:

« On February 8, 2006, AREVA NP and France ESSOR signed an agreement to complete the acquisition of

Sfarsteel, one of the world's leading manufacturers of very large forgings, in the Creusot basin(Burgundy). The integration of Sfarsteel into the Equipment business unit reinforces AREVA as a provider in the market of the new generation of reactors by securing the delivery times and the quality of the forged parts. Effect + € 33.8 million in 2006. »

In the Areva reference documents 2009 you can read more

"On November 4, 2008, AREVA and Japan Steelwork (JSW) have signed an agreement to ensure thatAreva will supply supplies of large forgings essential for nuclear equipment by 2016 and beyond .The Group has also announced that it will acquire a 1,3% share of JSW. »

In the reference books Areva of 2014 one can read:

"The market for nuclear forgings has long been bi-polar between Creusot Forge and its main competitor, Japan's JSW (Japan Steel Works) , which covers a large part of Western market demand for forgings. Since 2006 the offer has been expanded, with substantial investments in Germany, Italy, South Korea, China and India. '

Buy for € 47 million on a once again overvalued basis of what the group of Michel Yves Bolloré sold for 170.063.586 €, which represents - in the trans-sector - only 4.7 of its competitor JAPAN STEELWORKS

Overvaluation, which has been well-established over the years, when the JAPAN STEELWORKS shares are analyzed between 2008 and 2015, as appears in the Areva Group's reference documents , the number of shares remained stable at 4,830,000 before They are "volatilized"

Reference documents 2008 page 295: 4,830,000 units = 47,000,000 €

Reference documents 2009 page 291: 4,830,000 units = 43,000,000 €

Reference documents 2010 page 249: 4,830,000 shares = 38,000,000 €

Reference documents 2011 page 251: 4,830,000 shares = 26,000,000 €

(On 3 October 2011, Areva will remove the former SFARTSEEL from MY Bolloré, symbolically for 1, - €)

Reference documents 2012 Page 240: 4,830,000 units = 24,000,000 €

Reference documents 2013 page 239: 4,830,000 anchors = 20,000,000 €

Reference documents 2014 Page 221: 4,830,000 anchors = 14,000,000 €

Reference documents 2015 Page 218: 0 € without explanation

Why have you waited until JAPAN STEELWORKS 'participation is worth nothing to separate?

Summary

The acts of the Areva Group now compromise the industrial credibility of the country and the balances of the state budget. "The financial needs of Areva are more than double the total savings that the Finaz minister will have to meet by the end of 2017 to reach the 3% deficit of the budget deficit." *

Michel Yves Bolloré claimed during the summer 2006 negotiations that he sold his companies to Areva and that he was inspired by a kind of industrial Gaullism. For my part, I doubt that de Gaulle (if they had met) estimated such a plunder of public budgets. His answer would be - quite euphemistically - quite brutal.

The public prosecutor's office has all this information available (see letter from Judge Renaud Van Ruymbeke of 1 January 2015 ) Why is not the investigation conducted? Because of the criminal statutory limitation of the facts? What date should be chosen to allow the beginning of the obliteration to occur, the date of the events, or the date on which these events became visible?

Should the responsibilities of this catastrophe be concealed for a longer period of time and the use of a deficient atomic technology component be blown through, in which no man can assess the consequences of a not-to-be-excluded crack in the reactor?

The answer is included in the question.